Until 2018, the Act on Personal Income Tax made it possible for employers, subject to fulfillment of the statutory conditions, to provide employees with employee housing support tax-free in an amount of up to 5 million forints in 5 years. Although this popular benefit form is no longer available from 2019, we must not forget about the subsequent inspection of the tax exemption and actual use of the housing support provided earlier as it may carry a tax risk.

Under employee housing support, certain employers could provide their employees tax-free support for the purchase, building, extension, modernization or disabled accessible transformation of flats and for the final repayment of or repayment on housing loans or housing loans received from former employers until the last day of December 2018. With this tax-free benefit option, employers could provide employees support in an amount equivalent to 30 percent of the purchase price or the full construction, extension, modernization or disabled accessible transformation of a flat but maximum 5 million forints. The amount of the support was restricted by the provision that the total amount of support disbursed under this title to the employee by the employer or other employers in the four years preceding the year of disbursement could not exceed 5 million forints on an aggregate basis.

Deadlines for the certification of the use of employee housing support

The law defined strict preconditions in relation to the eligibility for the tax-exempt benefit, which had to be certified with appropriate documents. Following use of the support, the legitimacy of use also has to be certified with documents.

Although this tax-free benefit scheme is eliminated from 2019, employers must not forget about the subsequent inspection of the tax exemption and the actual use of the support granted as deadlines were prescribed by law for the submission of the documents certifying the tax exemption and use of the support provided earlier and expiry of these deadlines is approaching fast.

In the table below, we summarized the dates until which specific benefits can be used and the deadlines for the submission to the employer of the documents certifying the use of the given benefit form.

Employee housing support can only be regarded tax-exempt if the employee has the certificates specified by legal regulations until 31 May of the year following the year of disbursement of the support or 31 May of the second year following the year of disbursement in the case of support provided for the construction, extension, modernization or disabled accessible transformation of a flat!

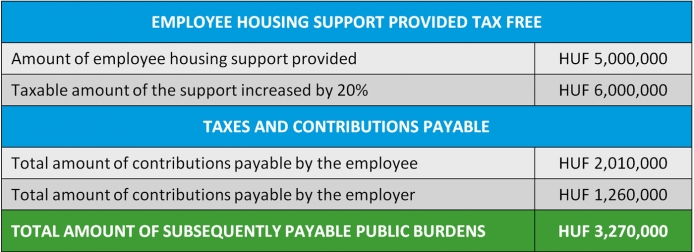

Caution! Personal income tax and wage contributions calculated based on an amount increased by 20 percent are at stake.

The scope of documents required for the certification of the use of the support is extensive. The subsequent obtaining of these may be difficult for the employer and the risk is also higher as the support provided will become taxable subsequently as wages in an amount increased by 20 percent on which both the employee and the employer will have to pay further taxes.

We illustrate on the example below the consequences arising if it is revealed during the subsequent inspection that tax-free employee housing support provided earlier to an employee in an amount of 5,000,000 forints does not qualify tax exempt after all.

From the above calculation we can draw the conclusion that if an employee is unable to certify until the relevant deadline the legitimate use of the 5,000,000 forint support received tax-free earlier, public burdens in a total amount of 3,270,000 forints will arise on the amount of the subsidy received increased by 20 percent (6,000,000 forints),which is 65.4 percent of the disbursed support amount. The employer will have tax liability equivalent to 25.2 percent of the support granted to the employee, which is 1,260,000 forints in the above case.

It is apparent from the above that we cannot just lay back after elimination of the tax exemption of this benefit form. Employees should and need to be informed as soon as possible of the scope of documents required to certify the tax exemption and the use of the support received and the final deadline for the submission of these. In addition, the employer should also check the compliance of the documents received from employees with requirements as soon as possible.

If the fulfillment of eligibility conditions was not tested in detail originally or if there are doubts of reliability in this regard, compliance should be tested in order to avoid risks and, if necessary, missing documents have to be obtained. We recommend, by all means, the involvement of experienced experts in the testing and review of the documents since, as noted above, the scope of documents necessary for the certification of tax exemption and use of the support is rather broad and an expert eye may mean huge help and relief in their testing.